History suggests the answer is a big fat, “forget about it!”

In the Nevada desert, the U.S. government was detonating a tactical nuclear weapon to keep ahead of the rival Soviets in the Cold War.

In New Jersey, a trotter named “Curtain Time” upset the chalk to take the fourth race at Garden State Park in Camden. About an hour later, “Excise Tax” rewarded that same chalk with a win in the eighth and final race of the day.

The date was October 31, 1951.

The next day the U.S. government detonated another nuclear bomb, this time over the business of bookmaking.

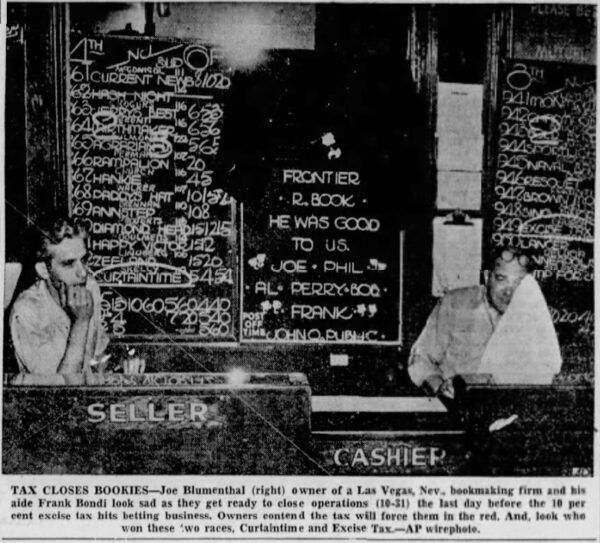

On November 1, 1951, a 10 percent federal excise tax on bookmaker handle became effective. For a brief period, the curtain fell on bookmaking throughout the country.

In Nevada, regulators at the state tax commission told bookmakers to pass the new tax burden on to their customers, the majority of which played horses. Instead, 20 of the 22 licensed turf clubs immediately closed their doors. The two in Reno that stayed open admitted players would not “kick in with the federal tax for very long.”

In Akron, Ohio, a pie-in-the-sky thinking newspaperman pitched a business model under which the bookies would pay the tax on losing-bet handle and horse players would pay the tax on winning-bet handle. A bookmaker with his feet firmly on the ground in the real world told him the players would not “hold still for it.”

In New York, legendary columnist Jimmy Cannon asked one of the bookmakers he respected most (probably Frank Erickson) if his customers might pick up his tax tab. The bookmaker told Cannon the horse players were “the stingiest of human beings.”

“Players love money just because it’s money,” the bookmaker said. “Give a player a million dollars to their name and they’ll still eat a hot dog for a banquet.”

For these reasons, if any bookie makes a line on the percentage of DraftKings’ customers that will pay DK’s taxes, give me the under.

Perhaps you are thinking I am just one of those stingy players of which Cannon’s bookmaker spoke.

It is true that I do not have any sympathy for DraftKings or any other bookmaker that now must bear crushing tax burdens in New York, Illinois, and Pennsylvania. If my bookmaker (FanDuel, not DraftKings) ever tries to claw back winnings to pay its tax burden here in Ohio, I simply will exercise my right to stop loaning it my money. I will find another bookmaker that does not expect me to subsidize its business. Or I will not bet. I lived 55 years here without licensed bookies. I enjoy an occasional wager and intensely handicapping the NFL. But the 11-to-10 is already brutal enough. If I have to pay the bookie even when I win, that takes all the fun out of winning. So, as Taylor Swift sings, I am not ever, ever, ever getting together with a bookmaker that demands I pay its taxes.

Moreover, as I set out in detail in my forthcoming book, Bookmakers vs. Ball Owners: Behind the Demolition of the U.S. Ban on Honorable Sports Betting and Bookmaking, these confiscatory state tax rates would not exist if the ball owners still had their right to exclude under PASPA. If the bookmakers had worked patiently to acquire the ball owners’ voluntary waiver of their right to enforce their right to exclude, the underlying right to exclude would still exist. In partnership with the ball owners, the bookmakers could use it as a shield against confiscation of their income.

But that is not what happened. The bookmakers gleefully destroyed the right to exclude shield. Now, the right to exclude state tax code writers and collectors from confiscating income is as fictional as a ring in one of those quest movies.

There is nothing—NOTHING!!–about this development that surprises me. I saw it ALL coming even before the Supreme Court blew up the PASPA dam.

A shield provides cover. The bookmakers won the PASPA battle. But due to their shortsightedness, they did not cover.

Like Pete Axthelm, I cannot stand being around a team that did not cover and thinks it won.

So, pay your own taxes, DraftKings. Or show a little respect for the players and just go away like the honorable bookies did in 1951.